How CMOs and leading marketers maximize their Return on Brand Investment (ROBI)

- Content: Article

- Date: 19 May 2022

A version of this article first appeared in the Forbes Communications Council, by Scott Turner, Forbes Communications Council Member and Chief Marketing Officer at BERA. Forbes Communications Council is an invitation-only community for executives in successful public relations, media strategy, and creative and advertising agencies.

Modern CMOs and marketing leaders who aspire to move up the ranks require a brand investor mentality; the days of common-sense marketing have gone. Instead, CMOs must have a risk-reward mentality and proactively mitigate risk and drive revenue if they wish to earn their seat at the table.

Your brand spend is more than just another marketing budget line item. Brand is the most important and influential investment in your company's future. Brand investments, when well placed, can build long-term value that ultimately paves the way for better business outcomes such as increased revenue and enterprise value. However, brand spending exceeds performance marketing and digital marketing.

These are popular LinkedIn conversations, but performance and digital marketing are often short-term plays. Brand spending, first and foremost, should be a long-term value build that ultimately paves the way for better performance marketing as a value add-on.

We know intuitively that we should spend on brand, but how do we judge successful brand investments? What metrics do we use? How do we track and measure brand performance and success?

Not to mention that lingering elephant in the room, bland brands create bland demand. So how do we avoid this and confidently learn where to steer the ship?

The answer is surprisingly straightforward; set up ongoing data collection on brand metrics that matter, such as Familiarity, Regard, Meaning, and Uniqueness–these are the building blocks of Brand Love. Next, act upon those findings with the coordinated focus of your product, place, price, promotion, and people.

As a CMO in the Predictive Brand Technology space, I've noted a few suggestions on how you can leverage data to maximize your ROBI (you can also download my ROBI industry insights).

Caring for an investment requires an investor mindset

Return on brand investment is the ratio of incremental value produced by brand growth divided by the amount of investment in brand growth. Maximizing ROBI requires brand communicators to adopt a brand investor mentality.

Gut feel can and does work for a while, but CMOs must have a risk-reward mentality and make data-driven decisions to embody this concept. Like their counterparts in the financial realm, brand investors will want to cut their brand losses and double down on their brand winners. This requires collecting data—and a lot of it. However, that's easier said than done.

Retail legend John Wanamaker once said, "Half my advertising spend is wasted; the trouble is, I don't know which half." While Wanamaker was assessing advertising effectiveness decades before the emergence of digital marketing, the same complaint applies to brand spending today.

Unlike digital advertising and performance marketing, which can be tracked, monitored, analyzed, sliced, diced, and pureed, investments in brands are notoriously difficult to tie back to impact on brand equity or incremental revenues. It's often a brand data problem.

Benefits of better brand investment decisions include:

Effectiveness: Brand investments have the desired outcomes

Efficiency: Making the best use of precious time and financial resources while avoiding unnecessary waste

Risk management: Brand decisions should not be a roll of the dice. They should be backed by data and have a degree of predictability.

As challenging as it may be to invest in brand equity, the results of other companies' successful brand-building efforts are all around us, even if they appear to be tantalizingly out of reach.

Some questions to consider:

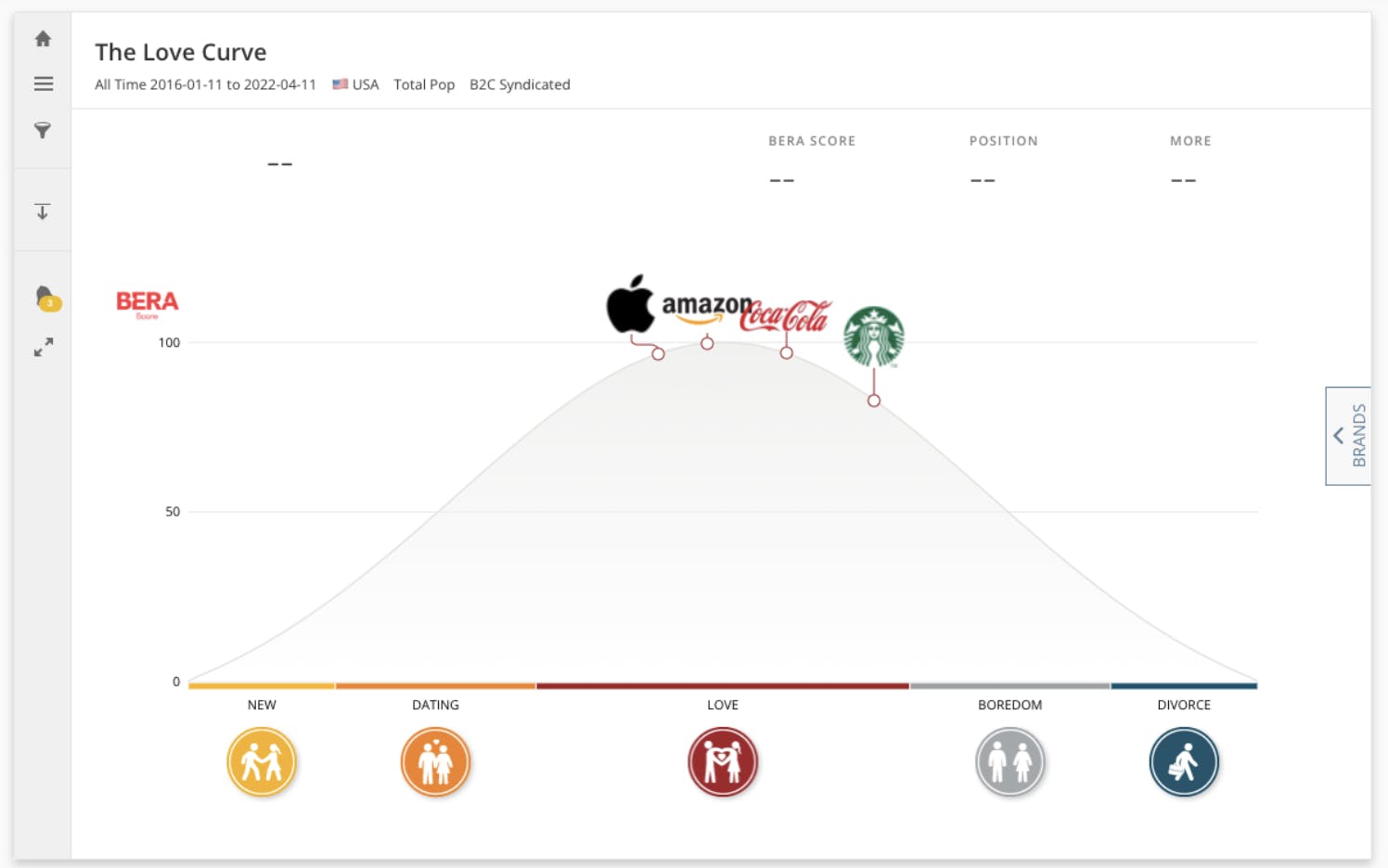

What are today’s winners like Coca-Cola, Starbucks, Amazon, and Apple doing right to maintain their Brand Love advantage?

What could brand leaders have done to anticipate their crumbling brand equity and revenue?

Equally important, what could they have done to halt and reverse the slide to Boredom (where consumers fall out of favor) or Divorce (where customers refuse to spend)?

Each of these questions is answered within the context of each brand's particular situation by the brand decisions that took place months, quarters, and years ahead of those business outcomes. If those brand bets are placed correctly, brand equity and revenues grow. If brand bets are rated poorly, that brand budget is wasted–the brand atrophies, revenue stagnates, financial projections are missed, and confidence in the brand marketing team is lost.

It's also worth mentioning that while marketing may be the steward of a brand, the entire organization has to help support and nourish the relationship. The best ad campaigns can't make up for a miserable product. Suppose the organization only views the brand as the communications and messaging or media output. In that case, you'll never reap the significant financial benefits generated when consumers connect and fall in with a brand.

Therefore, brand equity and revenues grow if brand bets are placed correctly. If brand bets are rated poorly, that brand budget is wasted, the brand atrophies, revenues stagnate, and financial projections are missed. Confidence in the brand and communications team is lost. Just as financial wizards rest their decisions upon data, excellent brand decisions require excellent brand data.

Measure your brand against the best to stand out from the rest

Maximizing your ROBI depends on looking not just at your brand and industry but at multiple brands across multiple industries. Why? The most accurate perception of your brand relies on context and culture when your brand is measured against brands in its category but brands across categories.

As Warren Buffett said, "A horse that can count to 10 is a remarkable horse, not a remarkable mathematician." In other words, don't judge your performance against your mediocre peers – compare yourself to the best!

Take, for instance, a consumer in need of a vacation. Your brand might be the best airline brand, but you're in trouble if your consumer thinks more highly of unwinding with a staycation that includes a local luxury hotel stay, some great local dining, and in-room movie streaming.

As a result, the airline brand might fall short of that alternative local package. So it would behoove you to compare yourself to other top-performing brands and travel experiences—not just your airline peers—when investing in brand equity.

Look beyond market research to decode customer and non-customer perceptions at scale

There's an old proverb: "The best time to plant a tree was 20 years ago. The second-best time is now." So contrary to limited scope and limited time-frame market research on your brand, you need ongoing intelligence across multiple industries and brands.

To ensure reliability over time, focus on continuously populating the same robust data stream in the same way over months and years. You'll also need to collect that data every week if you want real-time insights. And to ensure you trust your data, you will want to collect a lot of it and track that it reflects the real population (ideally with census matching for customers in the United States). This is expensive, but it can be done.

To that end, here are some dos and don'ts for maximizing your ROBI:

Don't:

Compare your brand performance to your industry peers. Instead, collect information on brand leaders across industries to learn what they are doing right, or waste brand budget, time, and effort pursuing vanity metrics like press mentions, website visits, or Net Promoter Scores (NPS). These are all fine data points, but they do not indicate effective or efficient brand spending.

Do:

Focus your brand investment on metrics that matter to building Brand Love, including your brand's Familiarity, Regard, Meaning, and Uniqueness (FRMU). First, consistently track Familiarity, Regard, Meaning, and Uniqueness performance across customers, geographies, demographics, and non-customer segments. Then, use the FRMU data to build a plan of attack that activates your five P's: product, place, price, promotion, and people.

Measuring the health of your brand investments

When it comes to measuring the health of your brand investments, a key theme among the top-performing brands is that they do a stellar job of building Brand Love through Familiarity, Regard, Meaning, and Uniqueness. Often, these brand investment decisions took place months, quarters, or even years ahead of those business outcomes. If brand bets are placed correctly, brand equity and revenues grow.

If brand bets are placed poorly, the budget is wasted, the brand atrophies, revenues stagnate, and financial projections are missed. Confidence in the brand and communications team is lost. Do you know whether you are aiming at the correct targets, or do you think you are? These are perils.

In the old days, marketing and brand leaders might narrow our decisions on whether to focus on gaining new customers that look like our existing customers or whether we need to target new demographics, perhaps even in new geographic markets or channels.

Vanity metrics marketers (and some boards) follow:

Press mentions

Website traffic

Social media impressions

Nielsen scores

Net Promoter Score (NPS)

To ensure you trust your data, marketing teams historically had to collect a lot of it and ensure it reflects the real population, as only census matching can. BERA stands for Brand Equity Relationship Assessment.

We conduct millions of customer interviews and collect billions of data points that uncover hundreds of measurements of Brand Love that stem from brand Familiarity, Regard, Meaning, and Uniqueness and bundle them into a single, digestible BERA Score.

Drivers of the BERA Score:

Brand Love: Familiarity, Regard, Meaning, and UniquenessFamiliarity, Regard, Meaning, and Uniqueness

Brand positioning attributes: Purpose, Emotional, Functional, Experimental

Audience: Loyals, Switchers, Prospects, Winbacks, Lapsed, Rejectors

Brand levers: Product, Price, Promotion, Place, and People

When all of your marketing and brand investments aim to grow your brand's BERA score, you can be assured that you are serving your short-term imperative – increase revenues – in ways that fortify your brand's long-term growth and profitability. The dichotomy between "short-term" and "long-term" is false (and dangerous) for both marketing and brand building. Every marketing and brand investment can – and should - serve both the short- and long-term.

When your company's business-building investments – e.g., products, channels, service – and business management processes – e.g., planning, resource allocation, incentive comp – are screened, directed, and evaluated for their impact on the BERA Score, you can be assured that they are contributing to your brand equity, and vice-versa.

For example, a major quick serve restaurant put nearly $130M annually behind its repositioning efforts and worked hard to earn PR attention. As a result, their CEO appeared on the TV to increase brand awareness, and the chain launched a controversial – but sellout – item in hunting-heavy markets; the brand now launches about 24 new products each year, compared to 2 in years prior, and increased its brand equity by 8%. And this isn't a one-off; many of the world's most influential brands rely on the BERA Score to understand their brand.

The role of AI in maximizing ROBI

While ROBI is not a pithy endeavor, it adds vibrancy and texture – and consequently – financial impact to organizations. Marketers who are open to leading the discussion on brand investment will stand apart from the crowd. CMOs and brand leaders can better understand their brand's current position and future direction and produce AI-powered recommendations to build Brand Love for suffering brands or strategies to keep the winners on top.

BERA provides systematic, ongoing, data-driven insights for brand leaders who need to make tough brand decisions that maximize their brand value. Sometimes, as in the examples above, those brand insights are non-obvious. However, when backed by customer data and analyzed rigorously, those brand insights can add millions (and billions) of dollars of revenue and enterprise value lift.

Contrary to limited scope and limited time-frame market research on your brand, you will need ongoing intelligence across multiple industries and brands. To ensure reliability over time, you will need to continuously populate the same robust data stream in the same way over months and years. If you want real-time insights, you will need to collect that data every week.

Of all the brand investment options available to you, real-time, data-driven ROBI analysis (as facilitated by your BERA Score) can indicate your best brand positioning strategy to tie your brand decisions to the business outcomes and financial results you and your board want.

Summary

Brand is an investment in your company's future. Brand investments, when well placed, will build long-term value that ultimately paves the way for better business outcomes such as increased revenue and enterprise value. Your ability to measure and drive ROBI depends on real-time, actionable insights driven by unbiased customer and non-customer benchmarks that reflect a validated brand-building framework.

BERA enables CMOs to focus on building Brand Love and make better business decisions to maximize their ROBI. Many of our customers have noted how tapping into these resources has the potential to save global organizations hundreds of thousands of dollars and hours invested in accumulating, and our always-on Predictive Brand Technology means we no longer live in the dark ages of brand management.

BERA also provides CMOs and brand leaders with data to communicate to CFOs, CEOs, and its boards to instill confidence that brand investments are well placed and that data truly back brand decisions. Brand used to be seen as an ambiguous money pit where creatives tried to out-duel one another. With the advent of Predictive Brand Technology, sparkles and rainbows no more. Instead, brand investments are a powerful, measurable, and accountable revenue-generating and enterprise value-building activity.

Ready to ramp up your ROBI? Download my industry insight, Maximizing the Return on Brand Investment, for actionable takeaways, from some of the world’s most influential brands.

About the author

Scott Turner, Chief Marketing Officer at BERA

A methodical optimist who believes that great marketing is a potent combination of persuasion and math, Scott Turner is an enterprise software growth marketing leader. Scott leads DevOps and AI, marketing teams, to rapidly develop and execute aggressive brand and demand generation goals. He has international (the US and Israel) board-facing experience reporting progress on brand awareness, pipeline growth, global expansion, new product, brand launches, M&A integration, team staffing and training, go-to-market plans, and budgets.